Veterans lenders also have more lenient credit conditions than simply traditional finance, making them a great selection for experts with poor credit.

Advanced Interest levels

An alternate advantage of an excellent Va financing would be the fact it has competitive interest rates. Because these loans are supported by the federal government, lenders also have pros which have straight down rates. This can save thousands of dollars along side life of your loan.

Case in point: when you find yourself to buy a $300,000 house or apartment with a 30-seasons home loan, good .5% escalation in your own interest rate might cost you an additional $34,000 across the longevity of the borrowed funds!

Re-finance Alternatives

Experts can also enjoy the VA’s Interest Prevention Home mortgage refinance loan (IRRRL) system, which enables you to definitely re-finance your Va home loan in order to decrease your rate of interest and you may payment per month.

Among the great benefits regarding a great Va home loan is that it can be utilized multiple times. If you have already used the Virtual assistant mortgage benefit and then have as reduced the mortgage, you could nonetheless put it to use once more to buy an alternate home.

You may want to play with pros home loans to re-finance an existing home loan, that will help you reduce your monthly payments and you will save money through the years.

No Individual Home loan Insurance policies

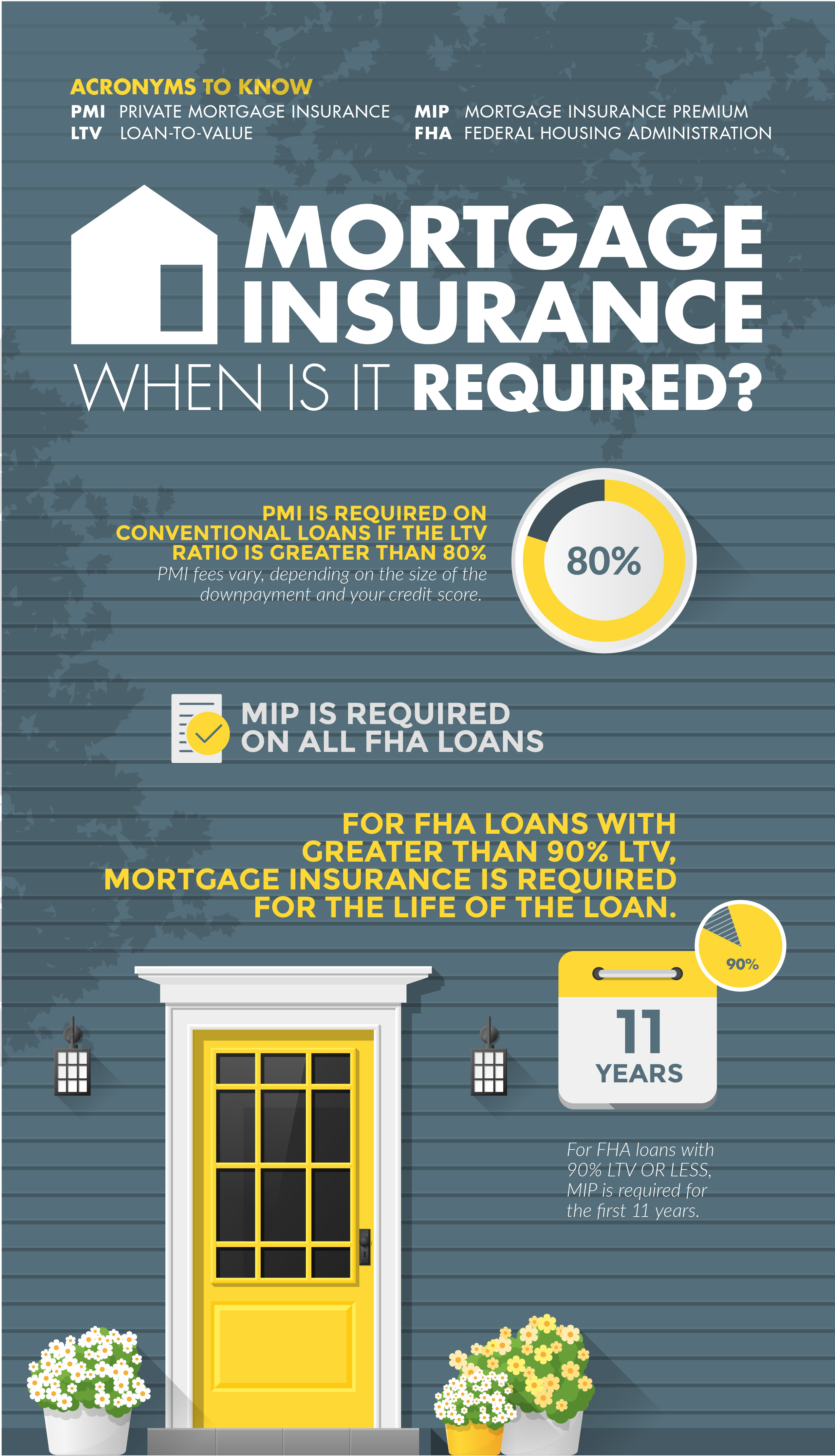

Personal Mortgage Insurance rates, or PMI, are an extra expense one specific borrowers need to pay when the they do not have a massive enough downpayment or if their credit rating should be highest. This can help you save several thousand dollars along the life of your loan. It’s not necessary to care about this extra cost having a great Va loan.

Thus whether you’re an initial-day homebuyer otherwise a talented resident, an effective Va home loan makes it possible to reach finally your hopes for homeownership.

step 3. Exactly how ought i policy for a beneficial Va Financial?

Planning the first home pick shall be challenging, specifically for experts trying to explore good Virtual assistant loan. If you are intending to the purchasing a property any time soon, budgeting for your house is a great idea.

Just how much domestic is it possible you afford?

Prior https://paydayloanalabama.com/lineville/ to even thinking about house, bringing pre-recognized getting a great Virtual assistant home loan can be helpful. This will give you a concept of maximum loan amount your qualify for, which can help you influence your allowance having a house.

There is no maximum Virtual assistant amount borrowed about Va, but not, the financial only allow you to use a specific amount predicated on their situation. Although not, in the event a lender pre-approves you for a leading matter, you might however buy a property in the a different selling price. Make certain you happen to be confident with new payment, as well as your financial, insurance policies, and you can assets taxes.

Think and you will Interest levels

You to extremely important foundation to adopt is the interest on your own loan, as is possible notably feeling your monthly mortgage repayment. While fixed-rates mortgage loans provide balance and predictability, it is important to just remember that , interest levels vary through the years.

Plan for Extra Costs

At exactly the same time, thought other expenses associated with buying property, instance settlement costs, property taxation, and you will homeowner’s insurance coverage. You can be required to shell out a Virtual assistant investment fee (more about it below).

Setting aside some money for unanticipated expenditures otherwise solutions which can arise after you move around in is also sensible. By using the full time to help you bundle and you may budget now, you can easily make the household-to order process significantly more in check.

cuatro. Are We eligible for experts lenders?

Before you apply having a good Virtual assistant mortgage, it is critical to understand the qualifications conditions and you will vital facts you to definitely make a difference your loan.

Provider Standards

To-be qualified to receive experts mortgage brokers, you must have served on the armed forces toward Active Duty, regarding the Reserves, or in brand new National Shield. The launch should be besides dishonorable.