- Varying anywhere between 650-750- This new score suggests that you’ve got a bad records that can result from bad debts, commission defaults if you don’t bad credit use. Having the get is put your risky and you may lenders will be suspicious off extending borrowing.

- Ranging anywhere between 750-850- The rating signifies that you have a terrible history which can come from money owed, fee defaults otherwise bad credit application. Acquiring the rating is also place your risky and lenders have a tendency to be suspicious regarding extending borrowing from the bank.

Knowing the Credit file – Key terms

NA or NH: Just like the a credit card otherwise financing debtor , you can find possibility that you’ll select a keen NA otherwise NH on the credit score. NA otherwise NH suggests there isn’t any, absolutely nothing, or lack of credit interest and work out research or to score an online credit rating.

DBT: This will be a sign of a skeptical condition whether your borrowing from the bank recommendations might have been inactive for more than 12 months.

LSS: That it opinion for the credit levels could be considered loss, so when a good defaulter for quite some time of your energy.

Created Out of/Settled Updates: In times , the brand new debtor are unable to complete the installment then payment commonly imply an authored off or settle position.

Qualification to own credit report

There clearly was a different sort of option way to located a duplicate of totally free credit history on five biggest credit reporting agencies . You can do this because of the fulfilling one of the following conditions as the offered regarding Reasonable Credit rating Act

You can even fulfill one of those requirements, while permitted you to definitely most free copy of your credit file during the one twelve-day months:

- If you’re out of work and you may propose to sign up for a position within 60 weeks

- If you find yourself receiving societal hobbies assistance

- Be sure that you believe that your credit history consists of incorrect guidance because of swindle

- If you have are refuted borrowing from the bank or insurance within the last sixty weeks

- You’ve made a scam alert on your own credit history

What is actually Credit Overseeing?

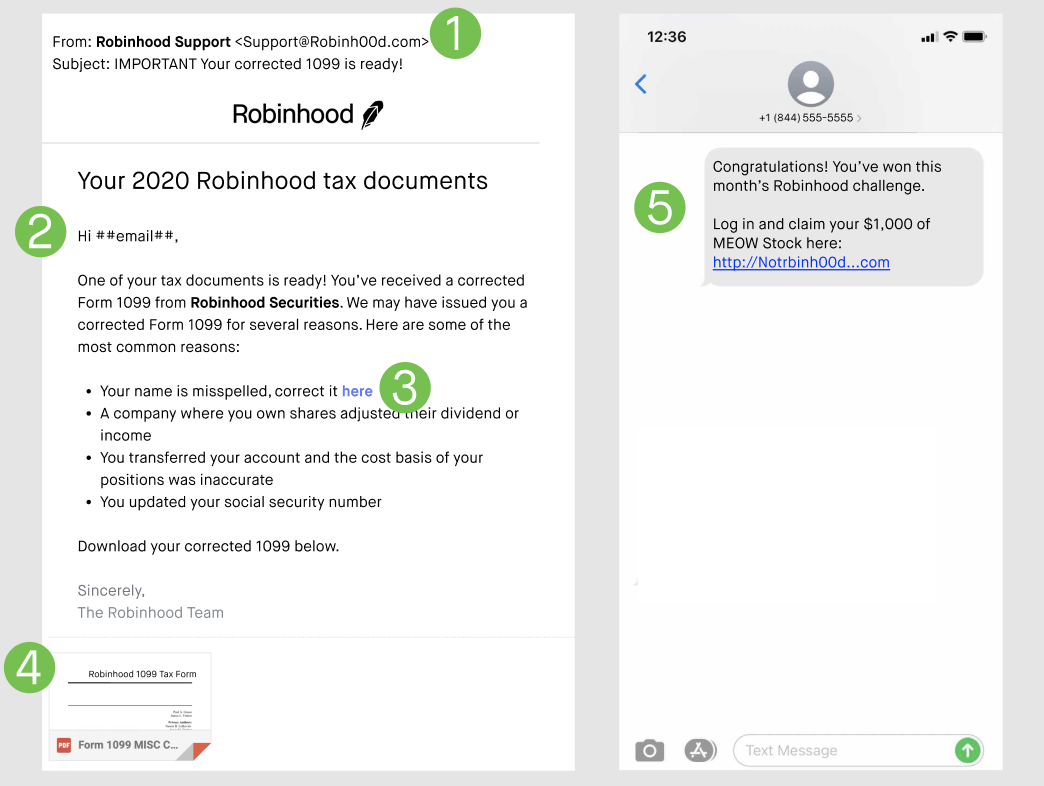

Keeping track of your borrowing form record credit rating or people discrepancies or skeptical passion . You’ll be a target of id theft that can hamper your credit rating and eventually your overall credit file .In addition to, there are many borrowing overseeing characteristics which help your look at the credit history with greater regularity. These types of services remark your credit report and you can alerts you however, if you’ve got come across people fraudulent situations otherwise errors. Plus if you aren’t interested in taking the assistance of a cards monitoring services, you can look at a few points and display your own borrowing from the bank alone. Now http://www.clickcashadvance.com/payday-loans-ia/riverside/ that you know very well what is basically credit keeping track of , you can proceed with the 2nd part one talks about the method that you can display screen the borrowing from the bank.

How do you Monitor Your credit rating?

It is vital to have a look at their charge card report each month since you may feel billed for many too many costs. You might like to end up being a victim off id theft or fraud. Although not , when you see any sort of skeptical interest on the borrowing credit, you might as well as reach out to your lender in order to rectify the problem within very first. It’s also advisable to check around when it comes down to unauthorized purchases which have already been used throughout your mastercard.

Get your Totally free Credit history:

All the five credit reporting agencies in the united states bring you to definitely free credit report and you will credit score for your requirements from inside the a season , forever from 2017. And therefore, it basically shows that you can purchase you four credit reports 100% free when you look at the per year. Its a great and you can essential habit to check on your credit history occasionally to cease people surprises such as for instance fake facts and too many borrowing from the bank questions.