Use of financial is essential having creating a economic activities and you can preventing the high charges have a tendency to for the choice economic functions. When you find yourself beginning a bank account are relatively easy, it will establish difficulty getting immigrants, as well as folks who are new to the us as well as have restricted English competence, and people who go into the nation rather than papers.

Together, you will find forty two.nine billion immigrants about U.S., 10.step 3 mil off which was undocumented. Information banking legal rights normally ensure that immigrants have the ability to access the latest financial services and products they need.

Key Takeaways

- You’ll find a projected 49.nine billion immigrants in america, in addition to 10.3 billion undocumented immigrants.

- Of numerous immigrants may well not understand the financial rights otherwise just how to discover a checking account, particularly if they lack the needed papers to do so.

- Code barriers may inhibit immigrants away from searching for the newest financial services they want to most useful do their cash.

- Becoming unaware of its financial liberties can potentially pricing immigrants various or even several thousand dollars in the so many charge.

Bank accounts and you may Immigration Standing

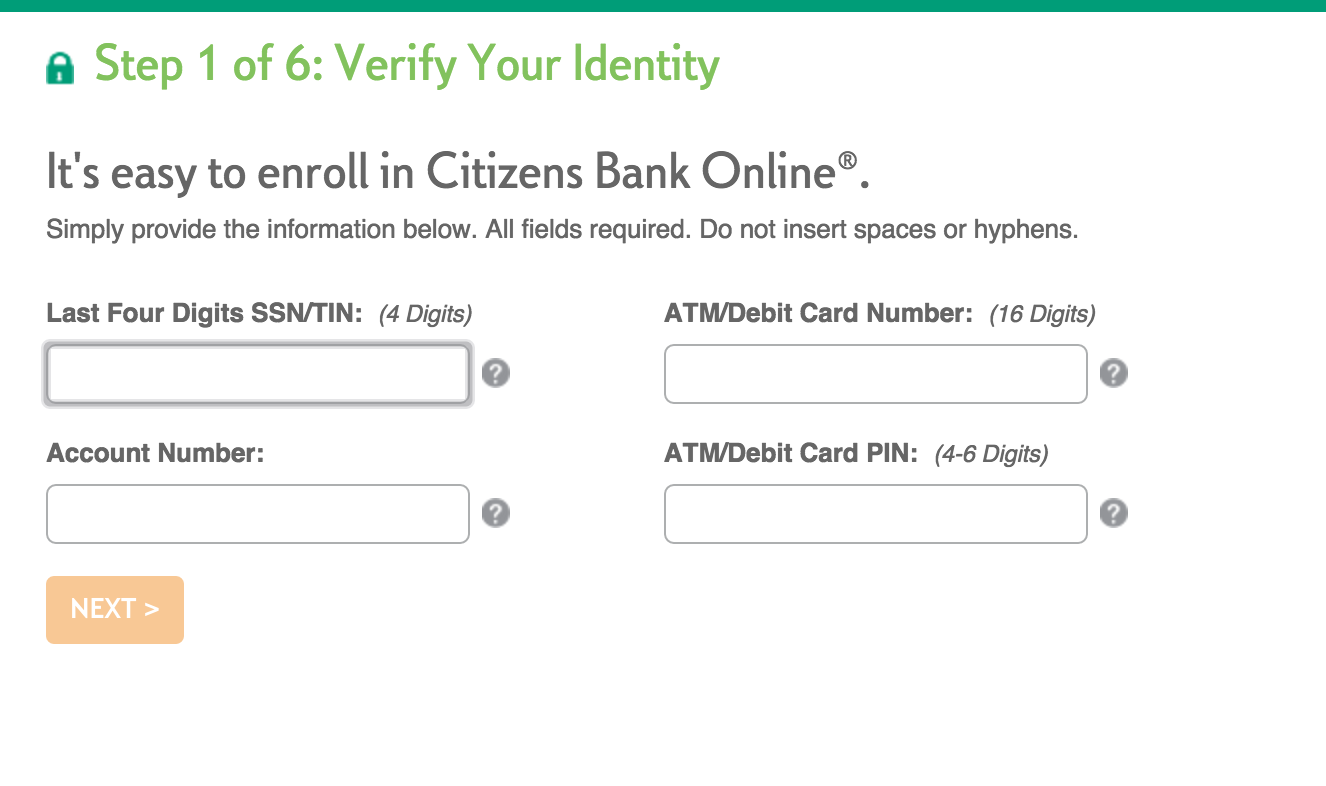

Probably one of the most commonly asked questions one to immigrants possess is whether or not it’s possible to open a bank checking account in the place of an excellent Public Coverage amount. The fresh new small answer is sure, one may rating a bank checking account in place of a social Cover matter if you possibly could provide other types of supporting paperwork otherwise character. An average advice that finance companies have to open a special membership tend to be their:

- Title

- Go out out-of beginning

- Address

- Personality

In lieu of a personal Safety matter, you’ll be able to possess immigrants to open a bank account playing with an Personal Taxpayer Identity Amount (ITIN). That it number, approved of the Irs (IRS), is perfect for individuals who don’t possess and generally are not eligible for a social Protection number. ITINs are provided no matter what immigration reputation and will be taken to open a bank checking account.

An ITIN will not approve one operate in the U.S., neither does it render qualification to possess Social Defense pros or qualify a depending having Earned Income tax Borrowing from the bank (EITC) motives.

- An excellent nonresident alien that has expected to document a beneficial You.S. taxation go back

Playing cards and Financing to own Immigrants

Getting a credit card or mortgage will help to meet financial need and certainly will getting an effective way to introduce and build good U.S. credit rating. Immigrants feel the straight to apply for loans and you can playing cards, and you will an abundance of banking companies and you will lenders give them. Discover, however, specific limits and exclusions.

Like, Deferred Action for Youth Arrivals (DACA) users try ineligible getting government education loan programs. However, they could to get individual student loans regarding financial institutions and other lenders, along with personal loans otherwise automotive loans. At the same time, other noncitizens could probably successfully apply for government beginner finance if they can offer sufficient files.

Particular Native Western college students born inside Canada which have a reputation around new Jay Treaty from 1789 can be qualified to receive federal beginner services.

Certification to own individual college loans, personal loans, auto loans, otherwise mortgages can differ regarding lender in order to lender. Like, zero verification out-of citizenship otherwise immigration reputation may be needed when the the application can provide an ITIN and you can proof income. An excellent passport or any other character can be expected to do the loan software.

As much as playing cards go, lots of monetary technology (fintech) businesses are suffering from credit affairs particularly for those who do not have a social Coverage matter. Individuals may use an enthusiastic ITIN alternatively to get approved. When they capable open an account, they can up coming explore you to definitely to ascertain and create a card record, which could make it more straightforward to be eligible for money.

Vast majority is actually a mobile banking software tailored for immigrants one boasts customized use of banking with no overdraft charges otherwise overseas deal fees.

Mortgages having Immigrants

To invest in a property typically function getting a mortgage, and you can immigrants feel the to make an application for a home loan regarding U.S. The most significant issue with providing acknowledged has been able to fulfill new lender’s certification conditions pertaining to employment records, credit rating, and you can evidence of money. Without having a credit score about You.S., for-instance, that can succeed much harder getting loan providers to evaluate the creditworthiness.

Opening a bank checking account which have a worldwide bank who may have You.S. branches otherwise having a great You.S. bank can help you to establish a monetary records. Once again, you could potentially is a line of credit bad discover a bank account having an enthusiastic ITIN, as well as your lender get will let you sign up for a mortgage with your ITIN too. Shopping around examine mortgage possibilities makes it possible to pick a lender which is willing to help you.

Providing more substantial downpayment make it easier to meet the requirements to possess a mortgage on the You.S. for those who have immigrant updates.

Sure, you could legally discover a checking account although you has a personal Cover matter and you can aside from their immigration updates. Numerous banks and you will credit unions undertake a variety out-of character records, together with one Taxpayer Character Number (ITIN), to start a checking account.

What is actually an ITIN?

The inner Funds Services (IRS) items ITINs to people who will be needed to file tax statements and are also maybe not permitted get a personal Defense amount. This new ITIN may be used in lieu of a personal Cover amount when opening another bank account or making an application for particular loans and you may handmade cards.

Perform I want to let you know immigration paperwork to start a financial membership?

No. Financial institutions and you can credit unions should not request you to prove their immigration reputation to open up a bank checking account. If you were to think one a bank or another standard bank was discerning up against you according to your own immigration standing, you might document an issue through the Government Set aside Bodies User Problem means on the internet.

Can also be illegal immigrants possess a bank account?

Yes, undocumented immigrants for the Us feel the to discover a bank account. Again, finance companies should not require you to prove your own immigration status to open a free account.