In the past 2 yrs, there has been many mention education loan forgiveness. The government is looking in order to make an application designed to let being qualified anyone escape education loan debt.

When you’re there are many viewpoints about this topic, student loan forgiveness may help young adults get its first home. This is a good procedure which will features positive consequences to own both the housing marketplace as well as the benefit in the long run.

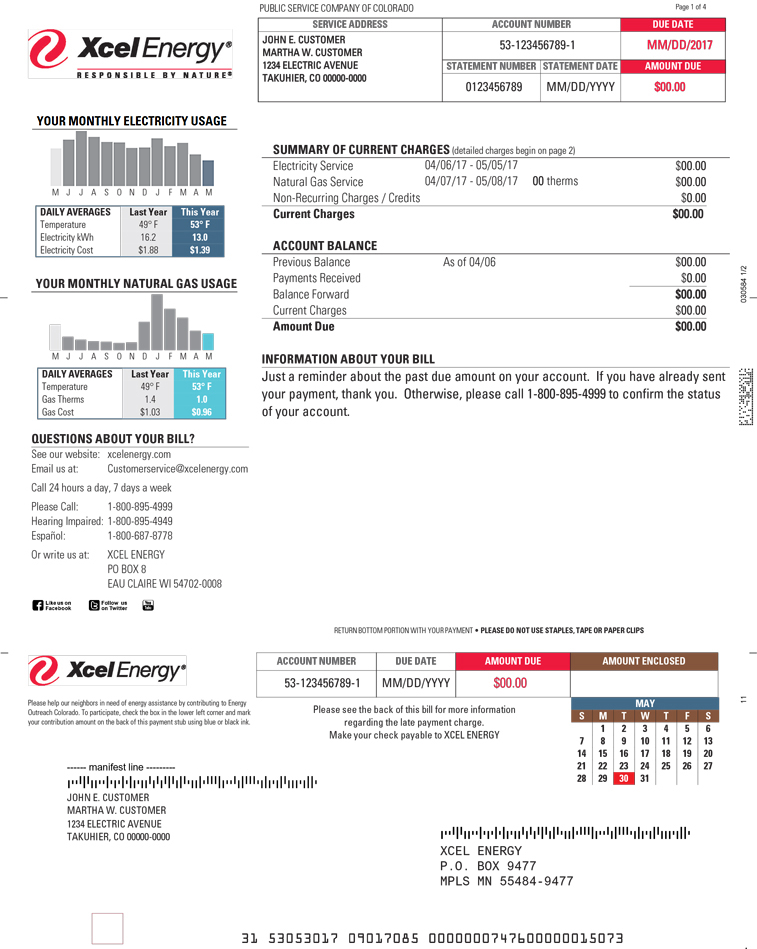

Listed below are 5 Says Willing to Pay off College loans having Homeowners

A growing number of locations and claims are offering education loan installment guidelines apps so you’re able to borrowers and you try not to also need get property.

They are going to pay back finance just in case you circulate around, purchase a home truth be told there, otherwise operate in certain markets. Just how higher would be the fact?

Many of these software are merely available to those with federal college loans and also make quick repayments. For those who belong to each other categories, let me reveal where you are able to rating a large percentage of your own figuratively speaking reduced.

Illinois

Home to Lincoln recently revealed good $25 mil financial support in its S to greatly help earliest-go out homebuyers with student obligations for the to acquire property. This choice comes with a beneficial $5,000 deferred-percentage financing having a down-payment, plus doing $forty,000 or fifteen% of the property’s worth (any kind of try faster) on the education loan fees. Your children money do not exceed $109,200 to help you qualify.

Michigan

Perhaps one of the most large education loan payment arrangements toward our very own checklist is provided of the Michigan, with a cover regarding $2 hundred,000 getting dental practitioners, physicians, and mental health masters. You need to works full-going back to at least two years within a low-finances hospital in a neighborhood that have a diminished medical benefits to be entitled to it award. A maximum of seven decades are permitted getting mortgage recommendations qualifications.

Maybe not a doctor otherwise dental practitioner? Explore Huron otherwise St. Clair Condition. For people who proceed to both of these counties and also a beneficial studies for the science, technical, engineering, the new arts, otherwise mathematics, you will be qualified to receive a face-to-face scholarship value anywhere between $10,000 and you will $15,000 to help you pay their college loans. Both counties provides provided sixteen scholarships and grants total given that program first started.

Maine

An opportunity Maine Tax Borrowing from the bank is offered of the condition in the event the you have got a stalk studies and you will pupil obligations. The state create refund your own minimum student loan payments because the good borrowing from the bank on the state income taxes for folks who graduated after 2008 and reside and work in Maine.

With regards to the 12 months your finished, there could be most constraints and you can regulations, so make sure you comment the needs. Even better work with, the fresh Fund Authority out-of Maine has actually students debt settlement system one to, for those who have a base education and you may work with an excellent Maine workplace, will pay the first $fifty,000 of your a fantastic education loan equilibrium to a max from $60,000.

California

The condition of Ca will forgive as much as $50,000 from inside the figuratively speaking having nurses, medical practitioner personnel, dental practitioners, or other medical care advantages. You truly must be doing work in individuals sector or at the good nonprofit team when you look at the an area where you will find a decreased medical care gurus to help you be eligible for new California Condition Mortgage Fees System. To help you qualify for guidelines, you ought to invest in benefit at least four years at the a lesser rate otherwise 2 years on complete-date employment.

Tx

The Lone Celebrity County try happy to advice about beginner financial obligation if you work in the new sphere out-of education, law, or health care.

You’re eligible for financial aid ranging from $4,800 so you can $180,000, with respect to the industry and program your submit an application for.

So that you won’t need to sit around waiting around for this new Government Regulators to do something. County software like these make it easier for teenagers so you’re able to qualify for home financing and buy a property.

Its smart doing your quest to find out if your state offers eg apps. Better still bring your neighborhood Embrace Home loans workplace a visit. We have been your neighborhood pros with your ears on the surface and you may great details about the local and you may condition apps.

Show it:

- X