Why don’t we be sure so you can extrapolate towards term bundle. Going right on through a separation and divorce feels as though operating cross country. You’ll have a plan for the channel you will need. However you’ll be able to deal with traffic jams, channels which might be finalized, injuries which can be unanticipated and you’ve got so you can adjust. That is to-be asked. And also for the sit-at-family mother, this travel is often much more difficult even as we manage ideas on how to progress and you may recreate our selves once the separation and divorce records was finalized.

You could potentially feel like you had made a binding agreement along with your partner that he was going to functions and you may secure, and you also have been gonna stay-at-home or take proper care of new students, nowadays the carpet has been yanked out of less than you, claims Emma Johnson, originator from WealthySingleMommy. It is an incredibly mentally wrought big date.

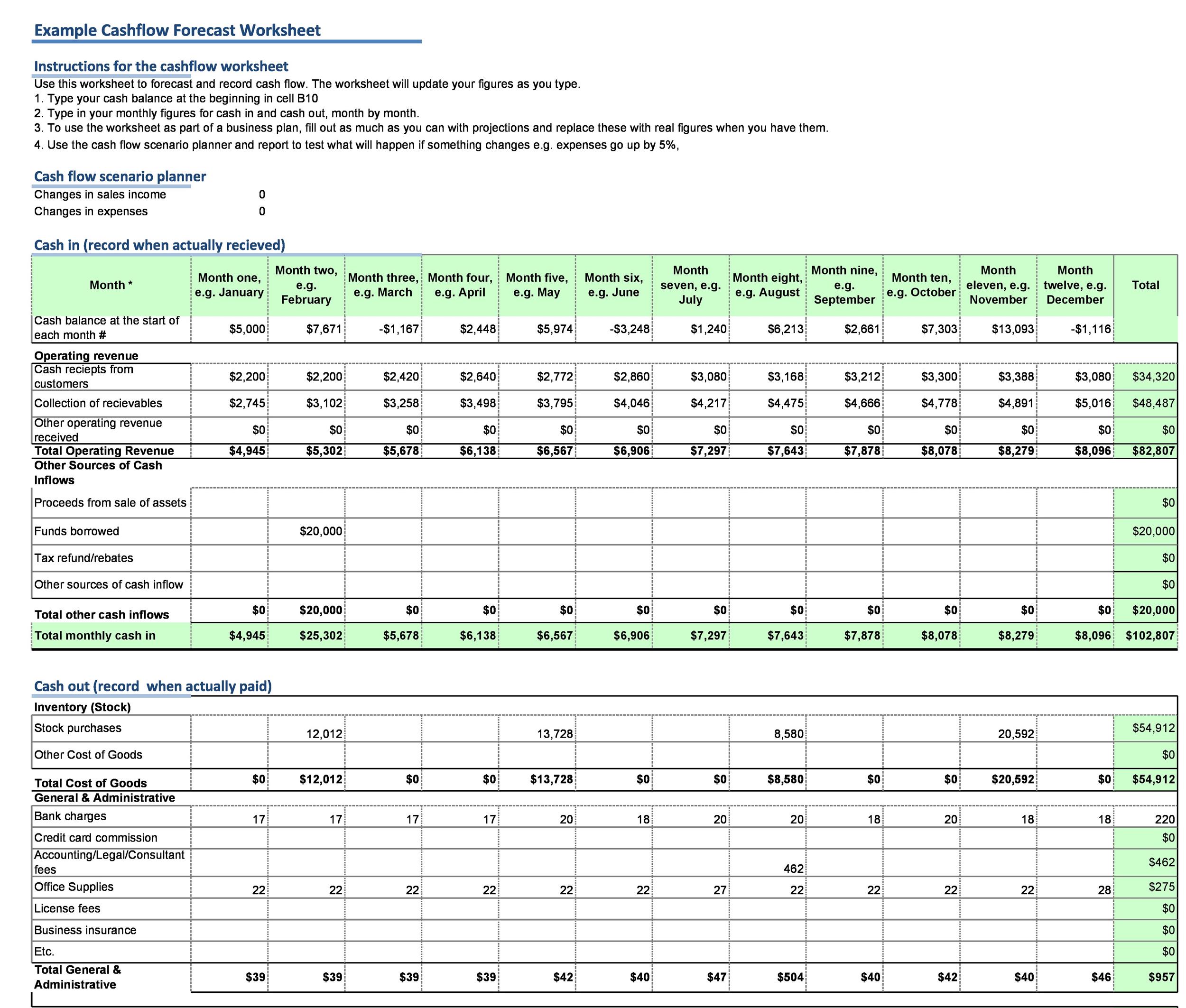

Shifting economically while the a stay-at-house mother means a peek at your inflows and you can outflows inside detail to see which the new typical is going to look instance, and ways to create improvements to get truth be told there. This is how to begin with:

Think carefully concerning your homes

Whenever you are keeping the household domestic might have been vital that you you mentally in the divorce case, its important to read the real will set you back off you to definitely domestic now that you are fully responsible for it.

Work at the fresh new number very carefully observe what kind of an impression downsizing to help you a more affordable home might have on your own money. Which means taking a look at the price of the borrowed funds by itself, also fees and insurance coverage and all of the monthly bills associated to the cost of the house and additionally tools, HOA and you will maintenance.

And be aware that enabling wade at some point are just the right circulate: If you can’t pay the home, everything else are going to be a-strain, says Carla Dearing, President out-of on the internet monetary thought service SUM180.

Work at their borrowing from the bank

Has just separated female often find one the credit score is leaner than they questioned , possibly because of worst obligations management since the two when they had been married otherwise as they didn’t have borrowing from the bank in their own labels during their relationships.

Regardless of the reason, since you are on the, improving your credit score is very important. A poor credit rating can prevent you against to be able to rent a flat if not apply at upcoming employment, while an excellent get will guarantee that one can supply funds at best you’ll costs. Initiate reconstructing your own by creating small purchases towards a charge card and spending all of them from quickly, and means other repeating money so you’re able to car spend, so that you may be never late. If in case you notice you cannot get a cards on the individual, apply for a guaranteed charge card pronto.

Step-back for the personnel

Even although you discovered youngster help otherwise alimony, you’re certain nevertheless have to-otherwise wanted-first off making money of one’s. The greater rapidly you could potentially move from stand-at-home-mommy in order to beginning to earn the currency, the greater number of rapidly you can safer your economic liberty and you can win back debt rely on. Begin by calling members of the family and you can previous coworkers so you can network and also the term aside on what types of functions you might such as for instance.

Even when you are not in a position otherwise in a position to jump back to business existence full-date, you can find benefits to brief-title and area-big date work and gigs.

There are some opportunities now, before you even discover your upcoming community circulate, to be effective part-time and make specific earnings to simply make-do and maintain things progressing, claims Jamie Hopkins, movie director of the Nyc Lifetime Cardiovascular system getting Retirement Income on the fresh new American College or university regarding Financial Features. The majority of people just be successful few days so you’re able to day before the correct career options opens up backup.

Manage americash loans Crested Butte oneself on the worst

Once the you will be fully accountable for the house’s cash, you will have to make sure that you might be prepared for the brand new unanticipated . One begins with a crisis pillow: Make an effort to set aside three to six months’ property value expenses, to ensure a medical facility bill or a leaky rooftop would not put all of your current finances regarding track. If because a-stay-at-home mother 3 to 6 months’ isn’t doable nowadays, start small, putting aside a bit each month increases smaller than just do you consider.

And additionally, believe handicap insurance coverage, that can cover your earnings while you are damage otherwise get sick and can’t work with a time. And you will, if for example the children are determined by you getting financial support, make sure you have sufficient life insurance coverage to acquire all of them due to school and you may towards mature lifetime.

Update your property plan

You’ll want to bring an alternative glance at your entire prevent-of-life records to see exactly what, or no, change have to be made. You may choose to reduce your ex lover-spouse while the beneficiary in your profile and you may employ an alternate health care proxy and stamina regarding attorney. In addition, you must do an alternative will, if in case you’d your partner-mate placed in their old usually states Stephanie Sandle, an official Economic Coordinator and you may managing movie director out of MAI Funding Administration. That way if things would be to occurs, you can make sure the new property visit who you wanted.

Think about, the audience is with you

Because the a stay-at-domestic mommy who’s got experienced a divorce proceedings, you have been due to a giant life alter. You will also have a list of activities to do, but fear maybe not, you will be a good HerMoney goal-getter! You 100% got that it, and you may we have been to you every step of one’s means. Signup all of us regarding HerMoney Myspace classification . The audience is plenty solid. And you will our company is talking about everything.