Good neighbor Next-door Program

When you need to pick property and you are either a the authorities manager, firefighter, teacher otherwise crisis medical specialist, the favorable Neighbor Next door Program may have the best deal in your case!

Its called the Good neighbor Next-door Program-a reward because of the You Institution out-of Homes and Metropolitan Advancement (HUD) to possess America’s an effective natives.

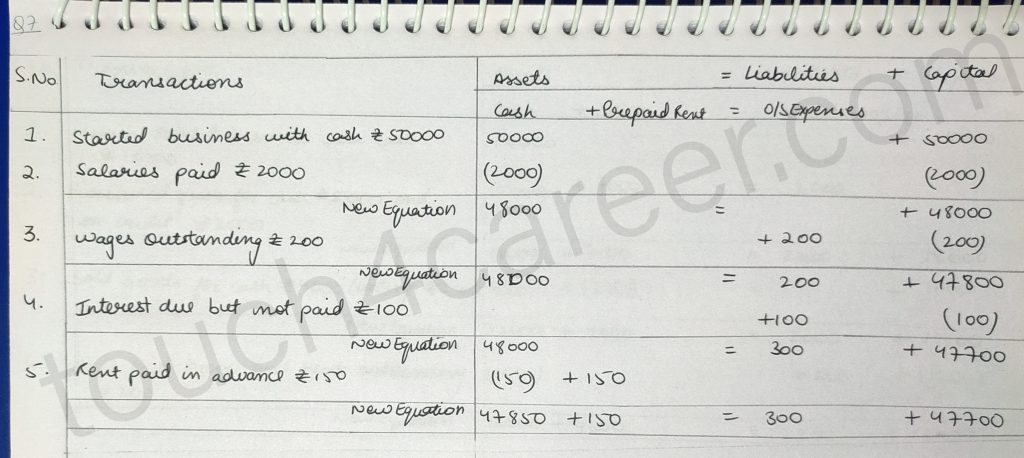

- Purchase HUD REO house for fifty% from list price with the current most recent financial cost.

- Only pay $100 advance payment after you pick one qualified HUD domestic within half-from their rates.

How come this new GNND Program Works?

Eligible Unmarried Family members residential property situated in revitalization section is actually indexed only obtainable from the Good-neighbor Next-door program (GNND) payday loan online Bristow Cove AL. Services are for sale to get through the system to own 1 week.

HUD requires that you sign one minute home loan and note getting the brand new discount number (50% Away from List Rates). No desire otherwise costs are needed on this subject hushed 2nd provided you satisfy the three-12 months occupancy requirement.

And that land meet the requirements into the GNND System?

Particular features inside certain neighborhoods is going to be an eligible HUD REO household. Most of the unmarried-device house qualify, considering he is discover contained in this a keen HUD designated revitalization city. Continue Reading The advantages of Good-neighbor Across the street Program simply speaking