Show them the small report that you write up exhibiting the latest differential of what can happen if they would vendor hold in the place of bringing the profit bucks

![]()

Just what exactly certainly are the pieces upcoming to offering a project? Number 1, you have to make yes the deal states as well as assigns. So if their name is Tom Smith the latest price should say that the consumer are Tom Smith as well as assigns because by that have that wording within it provides the flexibility to designate that bargain to anyone that you want. I do believe which is an important item getting inside. Another to the project is that you need to perhaps not care excessive on what happens in the closing. Some people get thus enthusiastic about the concept that the individual that’s attempting to sell you the park in person that they thought, “Oh gosh, they’ll be therefore bummed away from the me as i you should never let you know up at closure,” so they really morally become they can’t carry out the sell over project that’s not true. Mom and you may pop music already mainly based when they perhaps not likely to carry brand new papers these are generally merely getting a at the closing. It is a complete other contract whenever someone’s got provider investment in it.

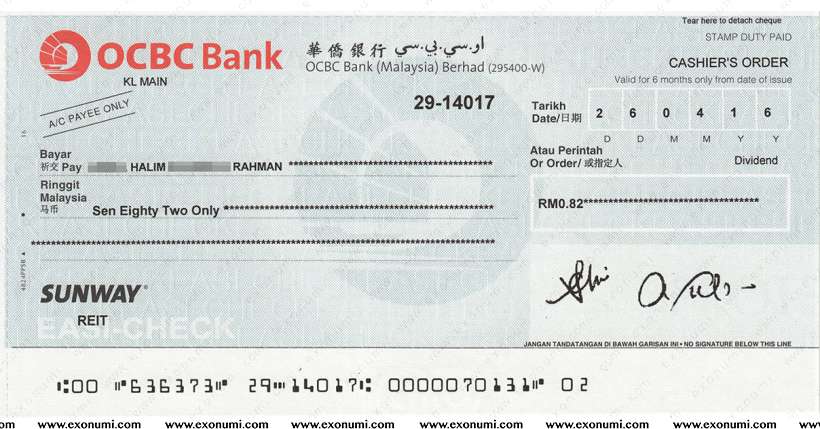

Such-like a provider financial support deal, yeah you can type of loans Quinebaug CT look for when mommy and you can pop perform become a tiny miffed in case the individual that fundamentally buys it isnt your. However if in which these are generally taking cash, it does not matter whom writes the fresh new consider. It simply will not also matter. Therefore never feel just like you can’t promote into the task given that which is an immoral thing to do. It’s not immoral at all. It’s very, really intellectual. It is an effective organization because that way the seller is going to have the currency that they wanted. Continue Reading Which does not matter which gives them this new examine