What are the number one differences between an enthusiastic HECM opposite home loan and you can a jumbo contrary financial? Area of the change is the fact HECM contrary mortgages try federally controlled and require financial insurance costs, while jumbo opposite mortgage loans commonly. Very reverse mortgages costs throughout the step 3-4% of the house worthy of, which have dos% browsing FHA insurance coverage. Which have jumbo contrary mortgage programs including Longbridge Rare metal, settlement costs was all the way down, just like a standard forward home loan, without having any dos% FHA payment.

Like, towards the a good $five hundred,000 household, FHA insurance coverage do costs $10,000 upfront. Good jumbo contrary home loan takes away which additionally the constant 0.5% payment, it is therefore a more rates-productive option.

In some cases, jumbo reverse mortgages supply extended qualifications considering possessions requirements. Particularly, condos are generally qualified to receive a HECM, nevertheless they have to be approved by the FHA. Jumbo opposite mortgages, particularly Longbridge Platinum, reduce stringent condo qualifications criteria. Why must somebody consider a good jumbo opposite mortgage? Good jumbo contrary financial is beneficial a variety of circumstances, especially for those with high home prices seeking to access greater levels of guarantee than simply provided with an excellent HECM. It can be very theraputic for individuals with functions that don’t meet the requirements place by the FHA getting HECM consumers It more income may be used as you want together with to pay off a current financial (a necessity of the loan) or consolidate expenses. Sometimes, a beneficial jumbo reverse home loan also provides high coupons as compared to the FHA HECM.

Along with, jumbo proprietary activities, like Longbridge Financial’s Precious metal Credit line are created specifically to help you deliver the flexibility, interest, and you can relatively reasonable costs the same as an excellent HELOC-however with reverse home loan benefits designed to satisfy new financial requires of retirees. It is a far greater complement of several earlier borrowers than just a vintage HELOC. Why do opposite mortgages are apt to have an awful connotation? Opposite mortgages have traditionally suffered from an awful connotation due to outdated attitudes. Although not, the applying keeps gone through tall improvements while keeping the core goal: helping elderly people to help you safely availability their house guarantee.

Very first, in the event the FHA produced opposite mortgages, there had been zero income or borrowing from the bank conditions in place-if perhaps you were 62, you accredited. So it inclusivity aimed to make the system accessible however, triggered unintended outcomes. Of numerous just who wouldn’t generally speaking be eligible for financing, or even for who a face-to-face financial wasn’t suitable, confronted foreclosures. This integrated clients having present bankruptcies whom put contrary mortgage loans as a temporary augment.

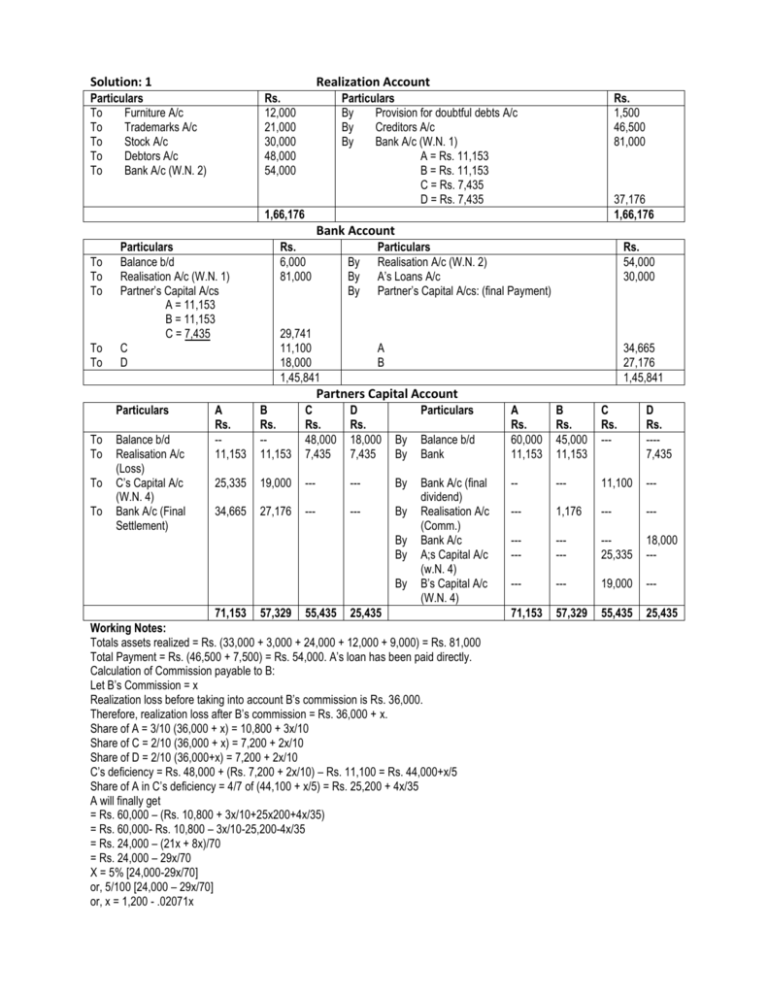

When you’re HECM contrary mortgage loans was subject to a max federal financing limitation place from the FHA, jumbo contrary mortgage loans commonly, which could allows you to access greater payday loans Oakman degrees of equity and you may more money

Taking these problems, the federal government has actually while the overhauled the fresh underwriting guidelines, swinging regarding no standards so you’re able to prominent-sense criteria. Today, we focus on the fresh creditworthiness and you may financial balance of our own clients so you can make sure capable live-in their houses properly and you can sustainably for the remainder of its life. As a result, additional requirements were placed into new HECM financing process, built to cover borrowers.

Opposite home loan guidance concerns ending up in an independent, third-people counselor authorized by the All of us Agency out of Construction and you will Metropolitan Creativity (HUD) counselor to discuss the reverse mortgage for the book problem, speak about alternative financial alternatives, and you may address any left concerns you may have.

Their financial will also request a credit score assessment to confirm a great reputation of fast money and you may find out if you’ve got adequate monetary info to meet up the mortgage conditions

As 2015, contrary home loan consumers need certainly to done a good HUD Financial Assessment, intended to stop default and you may property foreclosure. So it review aims to always are designed for duties such as for example assets fees, homeowners’ insurance rates, and you will family repair.