We all know you to definitely for some, the loan financing process might be challenging and you may perplexing. Don’t get worried! To your right information, preparing and a specialist financing administrator, the borrowed funds techniques can be quite simple and easy straightforward. From entry your loan software through to the date your romantic with the your dream domestic, all of us away from knowledgeable mortgage pros would be by your side, at the rear of your owing to every step in the process.

Let me reveal an in depth need of your own stages in the house mortgage techniques, and you may what you are able predict from inside the for each and every stage of one’s home loan loan:

The initial step: Pre-Certification

How much cash house should i be able to get, is sometimes one of the primary issues i hear when talking to a new customer. If you are far utilizes a finances and you will wants, using first step discover pre-entitled to a mortgage will help you address that concern. When you get pre-certified, you’ll work on an authorized mortgage administrator to establish a price diversity for the new home Derby quick loans. Predicated on that it price point, you’re getting a quotation of exactly what your monthly mortgage payments get feel. The loan administrator will also give an explanation for various other mortgage programs and down payment choice that you might have. At the conclusion of the newest pre-degree techniques the loan officer will question your a great pre-degree letter.

Along with your pre-degree letter at hand, you could begin our house search techniques understanding how much family you really can afford purchasing.

Second step: Domestic Hunting

Good real estate agent is actually part of the newest household browse processes. Not only will they manage to guide you home one to see your quest criteria on the price, but they are going to also be capable provide insight concerning the place, society, colleges and more. Once you find your ideal home, their real estate professional can also help you discuss cost and product sales terms and you can make your purchase bargain.

As soon as your render might have been approved of the a home vendor, youre reported to be less than price. Now you have to get to functions and you will ready yourself to close off on the domestic. Before you can commercially, close on the financial, you’ll find partners so much more steps in the mortgage process.

Step 3: Distribution a complete Application for the loan

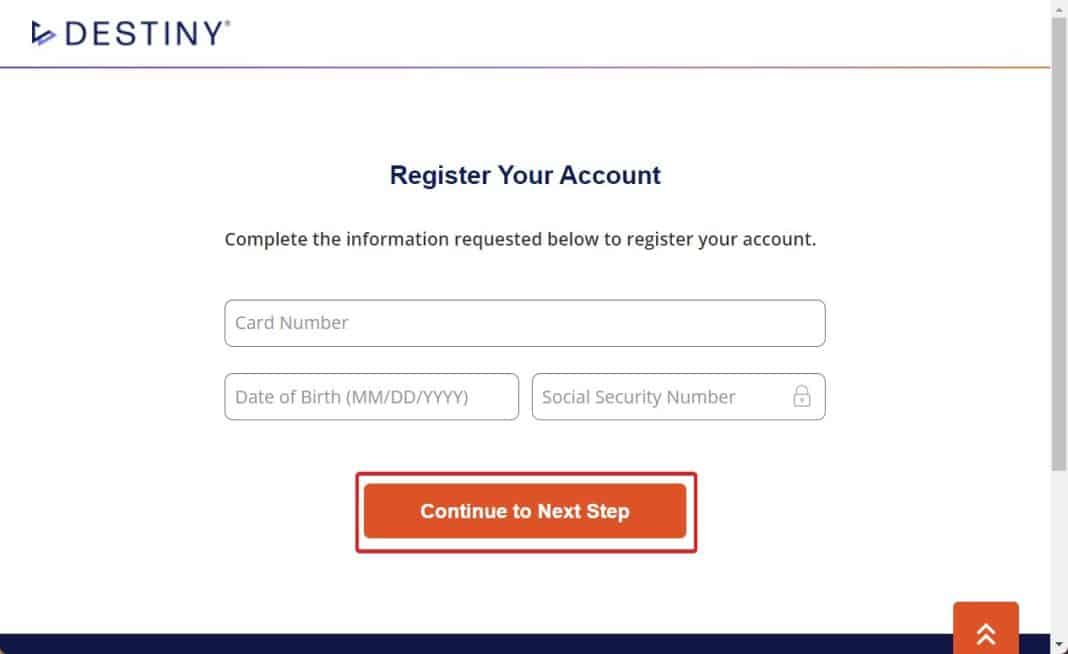

The next phase on financial procedure, once you may be around package, try entry an entire loan application. The mortgage software often thoroughly document information about your debts (along with every property, liabilities, your own borrowing from the bank profile), our home which you want to buy, and you will one co-consumers in fact it is purchasing the house or apartment with your. It’s also advisable to start the process of gathering all needed files so you’re able to support the funding of loan. The information considering on your own loan application would-be always examine what you can do to repay the financial.

At that phase of the financial application techniques you will feel handling the loan administrator to select the right mortgage equipment and you can advance payment number. After you have chose best home loan program and you will downpayment matter to your requirements, you will need to imagine locking in your interest. It’s important to remember that interest rates fluctuate predicated on sector requirements from day to night. That have a mortgage speed secure, you might be protected from any alterations in industry which could lead to pricing to increase. Whenever you are there is no particular timeframe on the mortgage process in which you have to secure your loan, when you have a favorable mortgage rate that meets your financial expectations, you ought to lock they.

And additionally getting the price secured, your lender will additionally give you a loan imagine based to your financing program and conditions that you’ve talked about. The borrowed funds guess is made to help you finest comprehend the regards to your own financial; they lays from mortgage conditions, the mortgage number, rate of interest, fees, settlement costs, estimated taxation, insurance policies, and you can monthly principal and interest money. You will need to remark your loan estimate very carefully and you will talk about people concerns otherwise concerns along with your Home loan Banker. Truth be told there must not be far difference between the mortgage estimate you earn early in your house financing techniques additionally the closure disclosure.