To track down a mortgage whenever you are controlling the student loan financial obligation, just be sure to make sure your profit try strong enough becoming accepted for 1. This could indicate preserving upwards having a substantial deposit or making sure your earnings can cover both your student loan repayments and you can home loan repayments, among other tips. By and opting for a lender with a reputation operating with borrowers carrying beginner loans, your application may stand a far greater risk of being approved.

Trick Takeaways

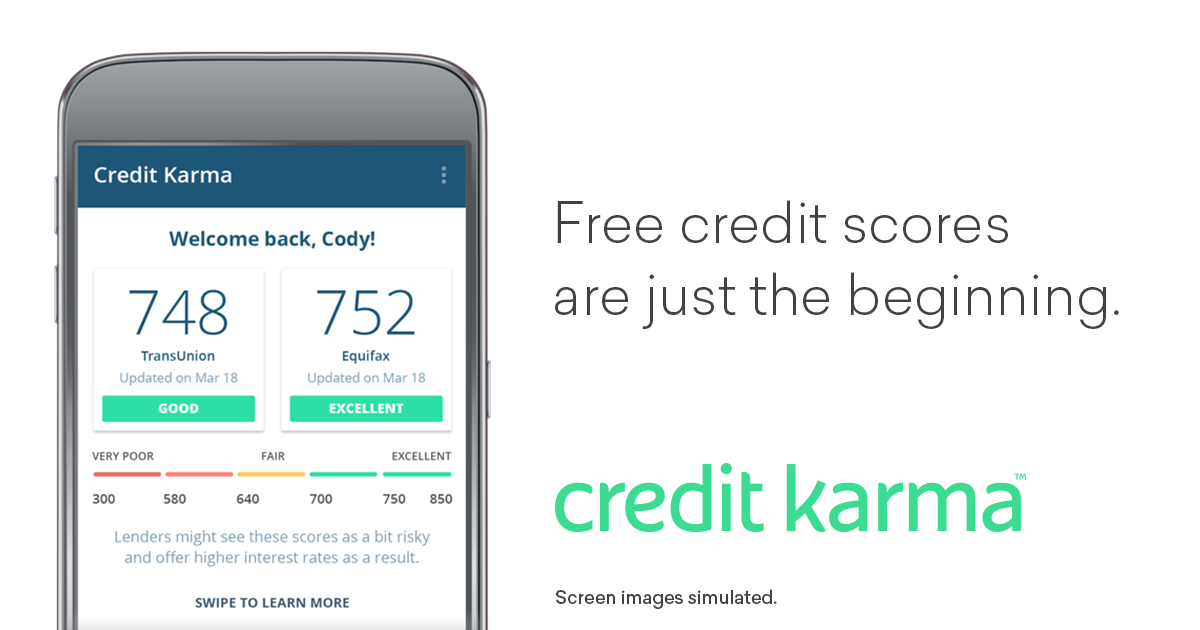

- Being qualified having home financing having student loan financial obligation typically necessitates conference specific financing conditions, instance which have the lowest debt-to-income (DTI) ratio and a high credit history.

- Mortgage forgiveness software and you may income-determined payment (IDR) arrangements helps you manage student loan personal debt while you follow homeownership.

- Envision working with loan providers who happen to be experienced with consumers that student loans.

Really does Student loan Debt Affect To get a house?

Which have education loan loans can affect whether you’re from inside the an excellent an excellent financial position to buy a house. And then make student loan money towards the top of home loan repayments is a financial filter systems.

Actually, of a lot millennials suggest student loan debt once the a primary need that they have defer to find property. All the $1,000 from inside the student loan obligations waits homeownership by from the five months. considering one Government Set-aside Board study.

Education loan loans has an effect on to purchase a property by eliminating the total amount away from readily available money you have available for a down payment since the better due to the fact casing repayments. As such, mortgage lenders try less likely to accept your when you hold a lot more personal debt and provide a diminished downpayment.

How Education loan Personal debt Impacts Mortgage Recognition

Student loan debt is roofed in the financial obligation that is used to calculate the debt-to-income (DTI) proportion. This is basically the complete quantity of your month-to-month personal debt costs opposed on monthly earnings.

When you’re on a living-motivated payment (IDR) plan and certainly will let you know brand new monthly amount of one lower fee, you’re able to lower your DTI this is why.

Understand that lenders may use a new formula in the event the you’ve got funds for the forbearance otherwise deferral. Such as for instance, you will possibly not be and then make repayments today, although bank must learn payday loans Coosada how to estimate your own DTI for future years to make sure you can afford this new financial.

- Remark the fresh the student loan harmony and profile the brand new payment from the 1% of that harmony.

- Go through the fees words and you will estimate a completely amortized fee.

Their month-to-month student loan percentage is put into your own other costs, including month-to-month credit card costs otherwise car and truck loans.

Better Ways to Would Student loan Loans When you find yourself Purchasing a house

Since you think about the domestic-buying processes, discover actions you can make use of to deal with your own education loan obligations making it simpler to qualify for a mortgage.

Paying Your own Education loan Obligations

Whenever you are which have a hard time preserving upwards to own an all the way down percentage to have property, you will be able to convenience your monthly cashflow because of the trying to get an IDR package. For individuals who be considered, you happen to be able to get a lower student loan payment, that would take back some money on the finances that can be placed for the saving having a downpayment.

A different sort of method is to pursue student loan forgiveness otherwise termination, no matter if this isn’t always an alternative that have personal figuratively speaking. Dependent on your situation along with your career, you might be able to find no less than a limited cancellation of financial obligation. Certain prospective programs are:

- Condition software offering some save for folks who enter into certain professions, eg health care otherwise training