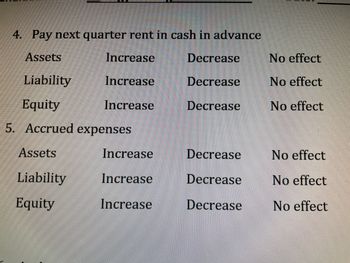

Your debt snowball and you may personal debt avalanche actions are a couple of prominent actions to have paying loans and you can reducing your debt-to-income proportion.

Your debt snowball method is for which you pay back your minuscule obligations basic, when you are still putting some minimum repayments towards the all almost every other debts. After you pay-off the littlest personal debt, your proceed to another littlest you to definitely and then the second minuscule one. This procedure also provide a feeling of success and inspiration just like the you find your debts decrease one at a time.

Your debt avalanche method pertains to repaying costs with the high interest levels basic, to make minimum payments to your other expense. By concentrating on highest-interest costs, you might slow down the overall level of appeal you pay over date, probably helping you save cash in tomorrow.

4. End playing with handmade cards

If you find yourself seeking lower your loansplus bank card is actually preventing you against and make genuine progressit could be best if you end utilizing it entirely. Cut-up their notes for folks who need, or at least put them out when you look at the a pantry. Next, work on paying off your obligations and ultizing dollars otherwise a beneficial debit credit to possess requests.

5. Discuss that have creditors

When you’re struggling to make money, its value contacting creditors to go over payment solutions. They can be prepared to leave you a reduced interest or help you create a payment package you to definitely most useful provides their funds. It might not constantly functions, however it is worthy of a go while trying to lower your DTI.

6. Improve income

Another way to reduce your personal debt-to-earnings ratio should be to increase your earnings. This may indicate using up an associate-date employment otherwise performing a part hustle. You might like to negotiate a raise at your current business or find high-expenses job opportunities. Focusing on raising your earnings are a sensible disperse if the there is no method to decrease your personal debt payments.

seven. Opinion your credit report

Review your credit history on a regular basis to make certain there are not any mistakes or discrepancies which could adversely perception the DTI. Dispute one problems you can see and you can try to change your borrowing rating by making for the-go out money and using borrowing from the bank responsibly.

Information the debt-to-earnings proportion

If you’re looking to alter debt health, that crucial metric knowing is your loans-to-earnings ratio. Their DTI measures up their month-to-month obligations repayments to the monthly income which is indicated as the a portion. A leading DTI helps it be hard to find approved having loans or borrowing, and can and signify you may be lifestyle beyond your form.

Essentially, loan providers will see a good DTI out of thirty six% otherwise lower. Thus the month-to-month debt payments should be no a whole lot more than simply thirty six% of the terrible monthly income. Although not, certain loan providers can get deal with DTI percentages as much as 43% if not 56.9%.

If for example the DTI is over such limitations, it may be an indication that you should take the appropriate steps to lessen your own DTI. These types of measures may include combining debt, with the snowball method of pay off balance, settling that have financial institutions, and also boosting your income.

Published by Cassidy Horton | Modified by Rose Wheeler

Cassidy Horton is a fund publisher who has got passionate about permitting some body get a hold of monetary liberty. Having an enthusiastic MBA my review here and an excellent bachelor’s in public areas connections, their own work has been authored more than good thousand times online because of the finance names such Forbes Advisor, The bill, PayPal, plus. Cassidy is additionally the fresh creator of money Hungry Freelancers, a patio that helps freelancers dump the financial be concerned.

Relevant listings

- How come Obligations Feeling Your ability to invest in a property?