- Your own date of beginning

- And that department your supported

- Your own review

- Their schedules off productive obligation

- Selection of at any time missing

- Sorts of discharge

- Are you presently permitted go back to provider

- Title and you will signature from commanding administrator

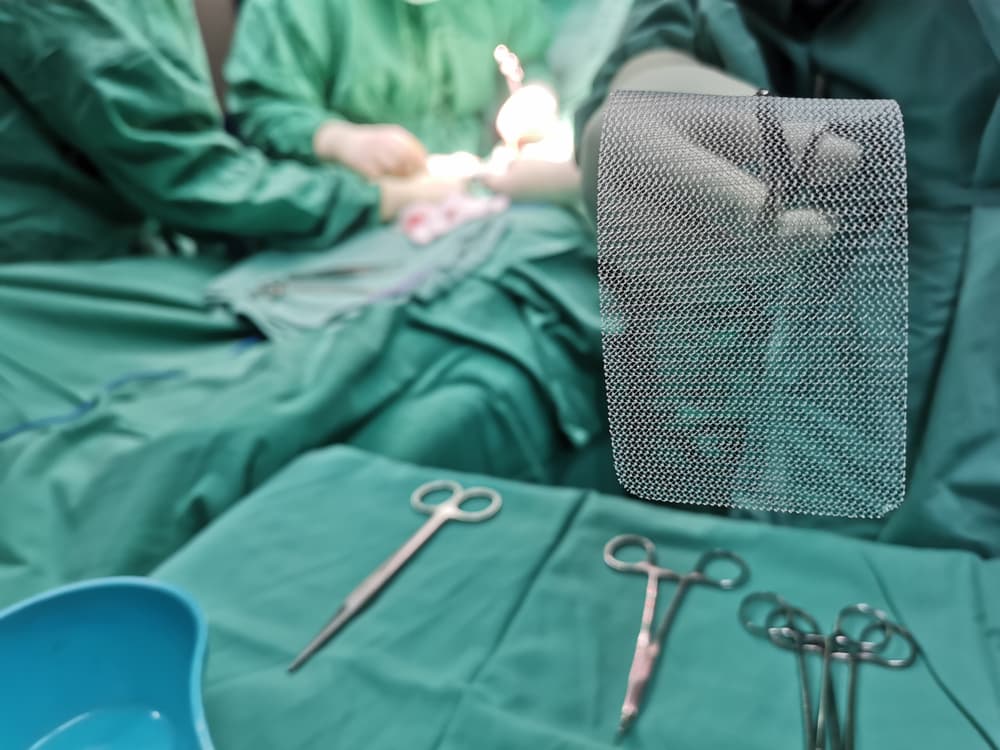

Va Loan Appraisal Criteria

The brand new Virtual assistant financing processes possess a number of standards which are not flexible, referring to one of them. You really must have the house or property you want purchasing appraised. Plus it must be done of the a beneficial Va-recognized appraiser. Thankfully there is a nation-wider circle of these appraisers therefore the Virtual assistant often designate one with the situation. The latest not so great news is, you will need to pay money for it ($525 and you may $step 1,five hundred, dependent on your local area buying your home).

Remember: the fresh appraisal isn’t the same as an evaluation. If you wish to understand what new appraiser could be searching having, you will find an email list.

Virtual assistant Loan Home Examination

Just like the appraisal processes is actually a requirement, the home inspection is not a good Va requirement. Chances are that your individual financial or mortgage broker will need you to perform a check, but it is good to remember the check is primarily around to protect you, the house visitors. In place of this new assessment, property inspector goes strong for the all the factors of your home, particularly:

- Electronic

If they get a hold of issues that result in the family hazardous or otherwise not-up-to help you password, they inform you what should be fixed. That impact the transactions towards the provider.

It is a different area where Home to possess Heroes may help. We hook up you to definitely a system from real estate professionals, and you may home inspectors are included in the team. I’ve inspectors across the country that see the means of army parents and you can experts. Furthermore, most of the Homes to own Heroes inspectors provide discounts to our armed forces heroes therefore have them prepared from the county.

Just like the Virtual assistant loan program doesn’t have the absolute minimum credit rating criteria, the personal loan providers which in fact give you the financing probably would. These mortgage brokers tend to have the absolute minimum you to selections ranging from 580 and 620. There’s something can be done to fix your own borrowing from the bank. When you yourself have a bankruptcy otherwise a foreclosures on your own early in the day, the fresh new Va is fairly good about providing you with a special options. Brand new prepared period to own a foreclosure is only two years and you can the brand new prepared months to own bankruptcy proceeding try anywhere between one year as well as 2 years.

Ok, have you got the Va financing be certain that and maybe you’ve got the mortgage and your new house. Are you presently over? Not if you don’t wish to be. The new Virtual assistant loan is a lifetime work with also it brings other financing guarantee functions that will help you with every house you very own.

One thing you should check into the ‘s the Va financial re-finance software. These may help you with your monthly funds plus full economic wellness. They have a couple of more loan pledges.

Virtual assistant IRRRL: The https://cashadvanceamerica.net/payday-loans/ interest rate Avoidance Refinance loan

The Virtual assistant Rate of interest Reduction Refinance loan, or Virtual assistant IRRRL, try a sleek refinance program that assists military benefits and you can veterans rework the newest money.

The brand new Virtual assistant IRRRL was a loan one changes your existing mortgage which have another Va-covered home loan, but this option has a diminished interest. They has actually your as part of the Virtual assistant Financing system, but with a diminished rate of interest keeps small-title and you may enough time-name pros.

It is important to remember that the newest IRRRL Va financing is only accessible to the present day Virtual assistant Mortgage owners. For people who haven’t gone through their procedure and started acknowledged to have (and you can obtained) good Va Loan, so it re-finance choice isn’t nowadays. If you have a good Va Mortgage, this may be another logical step for your requirements.